5 Factors That Influence Opportunity in the Denver Housing Market

Identifying opportunity in the housing market is as tricky as trying to time financial markets. Learn about 5 factors that impact home sales, and buying, and selling trends.

No one will deny that it’s been a rough two years. The pandemic, rising gas prices, home bidding wars, interest rate hikes, and international and political concerns. These ups and downs may have you wondering what will happen next.

If you listen to the news without applying a dose of logic or investigation, you might not realize that there is an opportunity in the Denver real estate market today. The spring real estate market begins in February so if you are interested in selling or buying now is the time to take action.

Watch Sam Wilson’s monthly video about the Denver real estate market to get the facts from the Denver Metro Association of Realtors January Report. Press the red play button in the photo below to play the video.

Opportunities in the Denver Real Estate Market: Tipis for Buyers and Sellers

Watch more video tips for home buyers and sellers on Sam’s YouTube Channel.

Influences on the Housing Market

The housing market is influenced by various factors including inventory, home prices, interest rates, unemployment, and remote work. Savvy home buyers and sellers who hire an experienced realtor can shortcut the learning curve to identify trends that open up windows of opportunity for buying and selling a home.

Let’s look at five factors that influence opportunities in the housing market by looking at the facts instead of the hype.

Housing Inventory

Housing inventory in the eleven-county Denver metro area remains tight. This means that, unlike other markets across the United States, home prices are remaining stable. The significant price increases and bidding wars of the past remain over—realism wins.

Buyers looking for a bargain basement deal or homeowners overpricing their homes will struggle to close the gap on realistic pricing.

- Residential (detached and attached home) listings at the end of January at 4,120 were -13.4% versus December 2022 at 4,757 but 247.9% up from January 2022 at 1,184.

- Year over year in January, there were 2,936 more homes for sale. Sellers and buyers are also wiser about balanced offers.

- Homes are taking twice as long to sell. Days in the MLS for January 2023 were 49 versus 22 in January 2022.

Buyers are no longer pressured to waive appraisals, which was a bargaining chip the past two years necessary to compete and win. Pressures to buy a fixer-upper to buy are also lower.

With the rise in interest rates not all buyers have the financial ability to buy a less-than-perfect home with the expectation of fixing it up. With the pressures of making an instant offer, home buyers now have more time to make a thoughtful investment.

- Looking at month-end active listings over time, the number of homes listed during the period of July to October 2022 peaked at over 7,000 a month.

- The 7,000 number was similar to the same months in 2015, 2016, and 2017 but slightly lower than in 2018 and 2019 when available homes exceeded 8,000 a month.

All in all, if 2022 trends repeat this means that the number of houses for sale on the market during summer 2023 will increase by about 50% from January figures.

Check out a current list of homes for sale in the Denver Metro Area

Home Prices

You might be surprised to learn that the average residential closed home price is fairly stable at $626,311. This represents -1.49% versus December 2022 at $635,769 but +2.83 versus January of 2022 at $609,056.

These numbers re-confirm the overall strength of the Denver real estate market as a desirable place to live. Buyer demand remains high and sellers have negotiating power.

Due to increases in home prices over time, many homebuyers in Denver have substantial equity built up in their homes. So while selling may be a concern, shifting home equity to buy a new home may result in a similar mortgage payment—even considering the rise in interest rates.

This year may be the perfect time to buy and sell to transition into a home that meets changing family and personal needs. It’s important to hire the right realtor who understands your need for downsizing, upsizing, or re-sizing to accommodate the need for a home office, growing children or empty nesting.

Interest Rates

The Federal Reserve continues its work to manage inflation and stabilize the economy. If automotive sales are any reflection of consumer spending, the shock of rising interest rates may be losing its effect.

According to Marklines, U.S. auto sales were up 5.8% in January 2023 versus a year ago when supply chain issues made car availability a challenge.

Models seeing the highest increases year over year were Ford F-Series, Chevrolet Silverado, Tesla Model Y, GMC Sierra, Honda CR-V, Tesla Model 3, Toyota Tacome, and Nissan Rogue.

On February 3, 2023, the average rate for a $300,000 loan with a 20% downpayment for 30-year fixed home loans was 6.975%, and for 15 years 5.821%.

Unemployment Rates

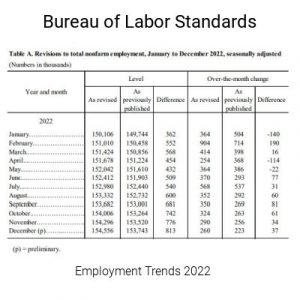

While politicians like to spin the news about employment rates and jobs, you can rely on getting the facts from the Bureau of Labor Standards in their monthly reports.

According to BLS, “both the unemployment rate at 3.4 percent and the number of unemployed persons at 5.7 million, changed little in January. The unemployment rate has shown little net movement since early 2022 (See table A-1).

Remote Work

It’s a new world for employees not required to show up at physical locations that support direct contact with the public. The pandemic spurred the possibility of remote work which seems to be a staying trend. It’s likely that flexible work arrangements will remain even though some companies are mandating a return to the office.

The ability to work remotely has resulted in the desire for homes with a larger number of bedrooms or those that already have a home office. This trend is expected to continue.

Additionally, companies are pivoting to update business models that address human resource policies for remote workers, increased cybersecurity, hybrid work models, time and productivity tracking, and other considerations.

An article by Finances Online features 17 remote work trends that will transform work-life and career advancement models for the future.

Real Estate Market Timing

Keeping these five trends that affect opportunity in the housing market, now may be the best time to sell or buy a home. The right time to sell or buy can be guided by practical needs and set a financial budget that can accommodate unexpected changes.

While everyone wants to feel that they are getting the best deal possible, the best way to do this is to work with an experienced realtor who can guide you in making the best decisions. Hiring a realtor with a wide base of knowledge and top-notch negotiating skills will ensure that you don’t leave money on the table but have more money in your pocket for things important to you.

Take Advantage of the Current Window of Opportunity in the Housing Market

Are you considering buying or selling a home in the Denver Metro Area? Get expert real estate advice from Sam Wilson, who has more than twenty years of experience in the local market.

Subscribe to Sam’s monthly market update newsletter.

Work with a seller or buyer’s agent on the Sam Wilson Home Selling Team. If you are thinking of buying or selling a home, the team will share years of expertise to make the home buying or selling process a financial win that is as stress-free as possible.

The Sam Wilson Home Selling Team specializes in homes in the Denver Metro area, including Arvada, Aspen Park, Aurora, Brighton, Broomfield, Centennial, Conifer, Denver, Edgewater, Evergreen, Genesee, Golden, Highlands Ranch, Idledale, Indian Hills, Ken Caryl, Kittredge, Lakeside, Lakewood, Littleton, Morrison, Mountain View, Parker, West Pleasant View, Westminster, and Wheat Ridge.

Contact Sam Wilson today.

© 2023 Sam Wilson. All Rights Reserved.