How Is the Housing Market Now in Denver?

How is the housing marketing now in Denver? Get the facts from Realtor® Sam Wilson about why the Denver real estate market and Lakewood Colorado is so hot for home sellers and home buyers. If you live in Colorado or are considering moving to the state, real estate sales and inventory in the eleven county Denver metro area (Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park) continue to be a hot topic.

In addition to learning how is the housing market now in Denver, this article offers education for home sellers and home buyers. You will learn about statistics and trends that affect housing markets not available elsewhere.

Become more educated about the relationship between inflation, interest rates, why home construction prices are skyrocketing, the effect of new housing starts on the economy, and why Denver is a hot housing market for home sellers and home buyers. Expertise and education about real estate offered by the Sam Wilson Home Selling Team are one of the many reasons clients have good things to say about Sam Wilson and Realtors on the Team.

Rising Inflation and the Effect on Interest Rates

If you have been watching or listening to the news, you’ve seen blips and threats about rising inflation. What is inflation?

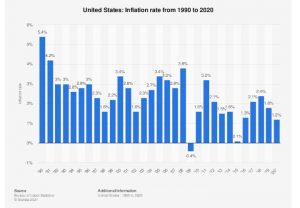

Inflation is a rise in prices for goods and services that households buy. From this chart, you can see inflation rate trends in the United States from 5.4% in 1990 to 1.2% in 2020.

If you are familiar with how inflation works, you know that the Federal Reserve Bank seeks to control inflation by influencing interest rates. Economists and investors watch for signs of statistics that predict trends.

This feature article and video with Janet Yellen U.S. Treasury Secretary from CNBC shares information about why interest rates are likely to rise as a result of higher inflation:

- May 4, 2021, CNBC “Treasury Secretary Yellen Says Rates May Have to Rise Somewhat To Keep Economy From Overheating”

Suppose you are unfamiliar with inflation and weren’t around for the crazy inflation of the 1970s and the effect on the economy and consumer spending. In that case, learn about inflation from the Federal Reserve Bank of Cleveland.

Why Does the Fed Care About Inflation?

To put today’s inflation potential into perspective and avoid worry and fake news, learn more here about 1970’s inflation and what might happen in the short-term future. Watch this video, CNBC How Today’s Inflation Fears Compare to the 1970s Rise.

How Do Interest Rates Affect Mortgage Payments?

Low interest rates have spoiled consumers looking to purchase homes, automobiles, and other large purchases that require obtaining mortgages and other loans.

According to the Denver Metro Association of REALTORS® almost 40 years ago, on October 9, 1981, the interest rate on a 30-year mortgage peaked at an astonishing 18.63 percent. Today that rate is just 3.04 percent.

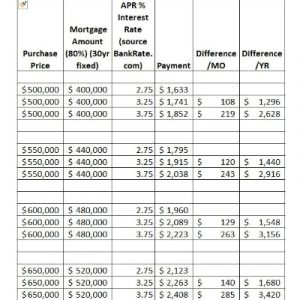

This chart illustrates why now is the perfect time to sell and buy a home in the Denver metro area and Lakewood, Colorado.

Home purchase prices are listed in the left column, with an 80% mortgage amount for a 30-year mortgage listed in the next column. As you can see, monthly mortgage payments rise between $100 to over $200 per month with each quarter percent increase in the interest rate.

How is the Housing Market Now in Denver?

What do rising interest rates mean for home sellers and home buyers in Denver right now? When you consider these Denver real estate market statistics, the numbers indicate that now is the time to sell and buy a home. The answer to how is the housing market now in Denver—it’s HOT and will likely remain one of the top housing markets in the United States for many years.

Residential Closed Homes in the Denver Eleven County Area

- The number of home sales closed during April 2021 was 5,088, an increase of 28.45% versus April 2020, confirming pent-up buyer demand for homes.

The monthly mortgage payment is the most significant indicator of what homebuyers can afford compared to their monthly incomes. If you are a home seller, rising interest rates over time will decrease the pool of potential homebuyers who can afford the monthly payment for homes in your price range.

How is the housing market now in Denver? Rising inflation and likely interest rate increases mean that now—during the hot summer real estate season—is the time to sell a home in the Denver metro area.

Median Closed Prices in the Denver Metro Area

- Real estate prices for residential homes continue to rise with a median closed price of $526,000, an increase of 6.19% versus March and 24.20% versus April of 2020. The cost of waiting to purchase a home month to month in 2021 continues to increase.

For homebuyers, month-to-month increases in home prices mean that now is the time to buy. Average days in the MLS (multiple listing service) remain low, meaning that the time-sensitivity of making an offer when buyers find their dream home remains critical. The answer to how is the housing market in Denver right now is great for home sellers and homebuyers.

New Housing Starts: Why The Real Estate Market Will Remain Hot

According to Investopedia, new housing starts are a leading economic indicator. If housing starts rise, it means builders are optimistic about the demand in the near future for newly constructed homes.

According to Investopedia, new housing starts are a leading economic indicator. If housing starts rise, it means builders are optimistic about the demand in the near future for newly constructed homes.

Information about housing starts is released around the 17 day of each month by the US Commerce Department.

Read the April 16, 2021 report from the United States Census and US Commerce Department about housing starts.

Below is summary information for April 2021 confirming growth in new housing starts:

- Privately-owned housing starts in March 2021 were 19.4% above the revised February 2021 estimate and 37% above March 2020

- Privately-owned housing completions in March 2021 were 16.6% percent above the revised February 2021 estimate and 23.4% above March 2020

Skyrocketing New Home Construction Prices

As discussed above, inflation is a rise in prices for goods and services that households buy. Goods and services purchased by businesses and home builders are higher, driving up new home construction costs. Demand for homes has outpaced the ability of home builders to meet the need.

For example, the price for a thousand board feet of lumber on the Chicago Mercantile Exchange hit a high at $1300 per 1,000 board feet. In April of 2020, the same lumber contract price was $328.50 per thousand board feet of lumber.

While demand for new homes remains high, the additional costs of lumber and other materials will continue to drive up new home construction prices. This means that that existing homes sales are and will remain attractive to homebuyers until new construction home inventory catches up to buyer demand.

If You Are Thinking of Buying or Selling – Contact the Sam Wilson Home Selling Team Today

Are you thinking about buying or selling a home in Lakewood, CO? Get expert real estate advice when house hunting for homes for sale in Lakewood, CO, Jefferson County, and the Denver metro area. Work with the Sam Wilson Home Selling Team. If you are thinking of buying or selling a home, we make you a priority and share our expertise to make the home buying or selling process as stress-free as possible.

The Sam Wilson Home Selling Team specializes in homes in Lakewood CO, and Jefferson County Colorado, including Arvada, Aspen Park, Conifer, Edgewater, Evergreen, Genesee, Golden, Idledale, Indian Hills, Ken Caryl, Kittredge, Lakeside, Lakewood, Littleton, Morrison, Mountain View, West Pleasant View, and Wheat Ridge.

Contact Sam Wilson today to learn more.

© 2021 Sam Wilson All Rights Reserved. Articles by Pamela D Wilson