Denver’s Housing Market Favoring Homebuyers

Welcome news. Denver’s housing market favoring home buyers seems to be a trend that might stay around for a while. Read the facts in the Denver Metro Association of Realtors June Report here and check out this video from Realtor® Sam Wilson.

The Current State of Denver’s Housing Market from Sam Wilson

Press the “play” button in the center of the photo below to play this video.

Check Out More Videos and Denver Market Reports on Sam’s YouTube Channel

If you’ve been trying to buy a home in the Denver metro area over the past year, you might have become exhausted by finding a home and then losing out to buyers bidding tens of thousands of dollars over the list price of a home. Fortunately, bidding wars, waiving appraisals, and home inspections are a past trend for home buyers.

The end of bidding wars and homes no longer selling in any condition may be disappointing news for home sellers who had the advantage for many months. However, as mentioned in recent monthly market reports, the impracticality of skyrocketing home prices had to end eventually.

So if you were a home buyer feeling priced out of the market, it’s more likely than ever to find your dream home in the Denver metro area.

The Number of New Home Listing Is Rising

Active home listings at the end of June 2022 in Denver were 6,057. This number is an increase of +65% versus May 2022 and +94% versus a year ago. Rising home inventory means more available homes on the market for buyers to see.

The key is to research so that you can focus on one or two areas of town that meet your specifications. So whether you are looking at school districts for children or proximity to work—know what is most important.

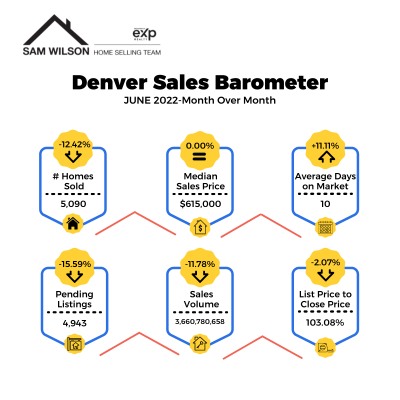

The number of closed homes at the end of June 2022 was 5,090, which is a -12.4% decrease versus May and -23.6% versus the prior year. The number of available homes on the market versus homes closing for sale means that there is now over a month’s inventory of homes for sale on the market.

Homes are no longer selling during the first weekend listed and may be taking several weeks to sell, depending on the selling strategy.

The Median Home Price is Flat

The median home price for the Denver metro area at the end of June 2022 was $615,000. This number is flat versus May 2022.

Month-to-month increases in home prices in Denver’s housing market have leveled off, resulting in less upward price pressure for home buyers. So instead of feeling stressed about rising costs and bidding wars, homebuyers can plan to offer at the list price—provided sellers did not overprice.

Home Sellers Still Overpricing

In June 2022, approximately 40% of home listings eventually resulted in a price reduction. Price reductions mean that sellers may be mentally following news and trends of the past. Or that realtors are unable to convince sellers that current pricing trends are here to stay.

If you are a home seller with a house sitting on the market, don’t wait to consider a price decrease, or you may lose out to other homes in the market priced right to sell. The DMAR report confirms that if a house has 20 or more showings and no offers, it’s likely to be overpriced, or sellers may ignore feedback about potential repairs or other buyer concerns.

As a seller, it can be challenging to hear buyer feedback about a home you love that you may have poured a lot of time into fixing up or updating. Listening to this feedback and making updates or changes is critical if you want to sell your home.

Average Days Listed in the MLS

Below are statistics for the average days homes are listed in the MLS for three pricing categories.

$500,000 to 749,000 Average days 9 in June versus 8 in May equates to a 12.5% increase

$750,000 to 999,999 Average days 12 in June versus 10 in May equates to a +20% increase

Homes $1,000,000+ Average days 15 in June versus 12 in May is a 25% increase

These statistics support a greater number of homes available on the market and the slower selling pace. This slowing may relieve home sellers who previously worried about the timing of buying their next home if their homes sold during the first weekend on the market.

The Effect of Rising Interest Rates on Homebuyers and Home Sellers

To slow inflation, the Federal Reserve Bank is continuing to raise interest rates. For homebuyers, this means that the monthly mortgage rate is rising.

So before the interest rate increases, you may have qualified to buy a home for $550,000. Now your top price may be $500,000.

For sellers, accepting that the days of skyrocketing home prices are over is key to selling your home. While there may not be a substantial number of recent comps, if you hire a realtor who has been in the market for ten or more years, he is she is more likely to be able to advise you on how to price your home.

If you are a home buyer, your credit score can impact the interest rate you receive on a mortgage and homeowner’s insurance.

For more on how to make your home buying experience more positive, especially if you are a first-time home buyer, read our blog post First Time Home Buyer Mistakes: 10 Tips to Avoid Homebuyers Remorse.

Is It Time to Buy or Sell a Home?

Are you considering buying a home in Denver’s housing market? If so, get expert real estate advice when searching for homes in the Denver metro area. Work with a buyer’s agent on the Sam Wilson Home Selling Team.

If you are thinking of buying or selling a home, we make you a priority and share years of expertise to make the home buying or selling process as stress-free as possible.

Check out what our clients have to say about us.

The Sam Wilson Home Selling Team specializes in homes in the Denver Metro area, including Arvada, Aspen Park, Aurora, Brighton, Broomfield, Centennial, Conifer, Denver, Edgewater, Evergreen, Genesee, Golden, Highlands Ranch, Idledale, Indian Hills, Ken Caryl, Kittredge, Lakeside, Lakewood, Littleton, Morrison, Mountain View, Parker, West Pleasant View, Westminster, and Wheat Ridge.

Contact Sam Wilson today

© 2022 Sam Wilson. All Rights Reserved. Articles by Pamela D Wilson