Denver Colorado Housing Prices 2022: The Cost of Waiting to Buy a Home

Consumer expectations about goods and services, including Denver housing prices and the cost of waiting to purchase a home, are highly influenced by media reporting, price changes in often purchased items like gasoline and food, and television and social media programming. For more on this topic, read the research article the Role of Television in Consumer Reality.

Press the “Play Arrow” button in the center of the photo below to watch Sam’s monthly market report video.

Interested in More Videos for Homebuyers and Home Sellers? Check Out Sam’s YouTube Channel Playlist.

Based on facts in the March Denver Metro Association of Realtors Market Report, Realtor® Sam Wilson offers a straightforward discussion in this article and the video above about Denver housing prices and ongoing media market predictions.

Learn what interested homebuyers and sellers can do to make the best of the current economic situation.

Home sellers and homebuyers will find plenty of links in this and other blog posts with research and facts about Denver housing prices, the cost of waiting to purchase a home, interest rates, and previous housing market boom and bust trends.

Denver Housing Prices and the Cost of Waiting

Let’s begin with the facts rather than focusing on media news predicting doom and gloom in the Denver housing market. To support the information presented in this article, you will find links to all of the referenced information.

All Transactions House Price Index for Denver Aurora Lakewood Colorado

If you are curious about how previous recessions affected the housing market, you’ll be able to view trends in this chart from the U.S. Federal Housing Financial Agency.

What is the meaning of the house price index? The House Price Index (HPI) is a broad measure of the movement of single-family property prices in the United States. Aside from serving as an indicator of house price trends, it also functions as an analytical tool for estimating changes in the rates of mortgage defaults, prepayments, and housing affordability.

To view the chart in a larger easier-to-read size CLICK HERE.

- The shaded vertical bars represent U.S. Recessions.

- You will see that over the past 40 years, from 1980 to the present, housing prices in Denver Aurora, and Lakewood Colorado rose from $100,000 to the new index of over $700,000.

Why is this chart relevant? In general, a recession caused by high inflation and rising interest rates can mean that there are fewer buyers. As a result, homes may stay on the market longer than average before selling.

Additionally, increases in interest rates by the Federal Reserve raise monthly mortgage payments and down payments. Refer to the chart below for more facts.

Subsequently, the effect on housing prices is difficult to predict, however it can vary between prices that continue to rise, stabilize, or decline.

Should I Wait? Is There A Housing Bubble in Denver?

If anyone tells you that they know what’s really about to happen with Denver housing prices, I’d question how they know.

Frankly, this prediction is challenging because we have never been here before. While there have been housing booms and busts in the past(1975, 1979, 1992, 2008) the pandemic, war in Ukraine, government spending, inflation, and interest rate hikes are the perfect storm creating an environment of uncertainty.

The bottom line is it’s all just speculation. And often, this speculation is self-serving – lenders say still an excellent time to buy, realtors always say great time to sell or buy.

The truth and my advice are always – what’s best for you.

- What’s yours, why?

- Why do you want or need to buy or sell?

Let’s explore both the pros and cons and decide whether to act or not.

March 2022 Trends for the Denver Real Estate Market

No matter how you look at the Denver real estate market, there are positive aspects for serious homebuyers and home sellers. The key is to recognize that the timing is right for you and to be ready to sell your home, make an offer, and move.

This is a market where being prepared and educated wins out over buyers or sellers who hesitate.

- Reports are that home sales inventory was up 81% in March versus February of 2022, but what was not revealed is the Thursday vs. Monday factor.

- Most homes come on the market on Thursday of each week and sell by Monday, meaning that if you are a homebuyer, Thursday is the time to work with a realtor to find your next home.

- If you are a home seller have a plan to buy your next home before you sell or when you list.

- Sam Wilson and his team educate homebuyers and sellers about a variety of financing, how to buy before you sell, and cash offer programs so that you can move ahead without hesitation.

- There is less than one home for sale for every two buyers in the market. Market competition in the Denver metro area remains high.

- In March, homes sold anywhere from 104-to 112% over list price for an average of 108%. Buyers are still paying more for homes which is great for sellers.

- 85% of all sales in March were over the asking price with multiple offers. And almost 100% of sales are in the 400-800K range.

- 72% of homes for sale went under contract in LESS than seven days – which is even faster than last year! Excellent for home sellers.

- “Coming soon listings” more than doubled the week of 4/2/3021, a house listed by our team had four offers sight unseen.

Denver Housing Supply Versus Demand

What can be predicted by market statistics and interest rate calculations is Denver housing prices and the cost of waiting based on supply and demand.

The March report confirms that based on showing data and demand, there need to be 12-13 listings available to satisfy demand. There have been less than 2,000 available homes for sale at any given time, so demand exceeds supply.

The underlying fundamental remains – low supply and high demand. Therefore, in the Denver metro, there is no appearance of a bubble or price crash any time soon. Perhaps only slowing.

Mortgage rates will continue to rise commensurate with the Federal Reserve rate increases that drive up the 10-year treasury yield which results in rising mortgage interest rates.

Strategies for Homebuyers and Homesellers

Know your why! Become educated about all of your options specific to Denver housing prices and the cost of waiting for your personal situation.

If you choose to wait for price and mortgage reductions, it might be a long wait for the market to level out. And then the term level out is relative, to what?

What remains to be seen is how high is high for Denver area home prices and mortgage rates. All indications are that Denver might not be at the top yet.

The Cost of Waiting to Purchase a Home (for a larger copy of the chart below call or text 303-770-1250)

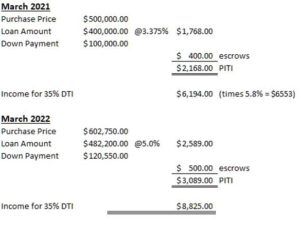

The chart below compares housing prices from March 2021 to 2022, rising interest rates, and increases in mortgage payments. There is no disputing that waiting to buy a home in the Denver market has associated financial costs.

- An increase in home prices of $100,000 from March 2021 to March 2022.

- An increase in the loan amount by $82,000

- Interest rate increases from 3.375 to 5% resulting in a payment comparison of $2168 to $3089 per month

If you want a factual analysis of Denver housing prices and the cost of waiting based on your personal situation, call or text 303-770-1250. Sam Wilson and realtors on his team can put pen to paper and create a spreadsheet so that you can realistically look at your options. As always there is no obligation to sell or buy in return for receiving information and education from realtors on the Sam Wilson Home Selling Team. Learn what clients have to say about the level of service and education we provide.

Interested in more articles for homebuyers? Read our blog post First Time Homebuyer Mistakes: 10 Tips to Avoid Buyer Remorse.

The Effect of Rising Interest Rates

While it may seem that home buying may not be a good idea in periods of inflation, owning a home may be a hedge against future inflation if you are renting and experiencing substantial rent increases year to year. Another question that everyone asks is—is buying a house a better investment than putting money into the financial markets.

If you look at the rise in housing prices over the last several years in Denver, the answer is yes but only if you are in a position to sell your home to access the home equity. Which takes us back to my initial question, what is your motivation to sell? That may be the one fact you know that takes all of the other issues off the table.

Home Sellers and Homebuyers Can Find Peace of Mind

Buying and selling a home is a major financial decision. Unfortunately, it’s usually not possible for the average consumer to keep up with all aspects of real estate. This is why using a real estate specialist like Sam Wilson and the Sam Wilson Home Selling Team gives homebuyers and home sellers the information they need to know when making one of the most critical decisions of their lives.

Work with agents who prioritize your needs and share their expertise to make the home buying or selling process as stress-free as possible. With a plan and a trusted real estate advisor, you will feel in control of the choices and the process of buying or selling a home.

Subscribe to our newsletter—it’s FREE. You will receive real estate tips, trends, and the latest real estate blog posts.

The Sam Wilson Home Selling Team specializes in homes in the Denver Metro area, including Arvada, Aspen Park, Aurora, Brighton, Broomfield, Centennial, Conifer, Denver, Edgewater, Evergreen, Genesee, Golden, Highlands Ranch, Idledale, Indian Hills, Ken Caryl, Kittredge, Lakeside, Lakewood, Littleton, Morrison, Mountain View, Parker, West Pleasant View, Westminster, and Wheat Ridge.

Contact Sam Wilson today.

© 2022 Sam Wilson All Rights Reserved. Articles by Pamela D Wilson